Household Employee Threshold 2024

Household Employee Threshold 2024. Here is a list of forms that household employers need to complete. Social security and medicare taxes apply to election workers who are paid $2,300 or.

Nov 17, 2023 | gtm blog, household payroll & taxes, tax & wage laws. Nanny tax threshold increases for 2024.

Find Details On Tax Filing Requirements With.

Schedule h (form 1040) for figuring your household employment taxes.

If You Pay Your Household Employee Cash Wages Of $2,700 Or More In 2024, All Cash Wages You Pay To That Employee In 2024, Up To $168,600, (Regardless Of When.

Deducting social security and medicare taxes.

The Irs Annually Reviews, And Adjusts As Necessary, The Wage Payment Threshold That Obligates A.

Images References :

Source: atonce.com

Source: atonce.com

Maximize Your Paycheck Understanding FICA Tax in 2024, That is, you're not required to withhold. Congress enacted aca with a 9.5% affordability threshold, but that number changes annually to reflect cost of living adjustments.

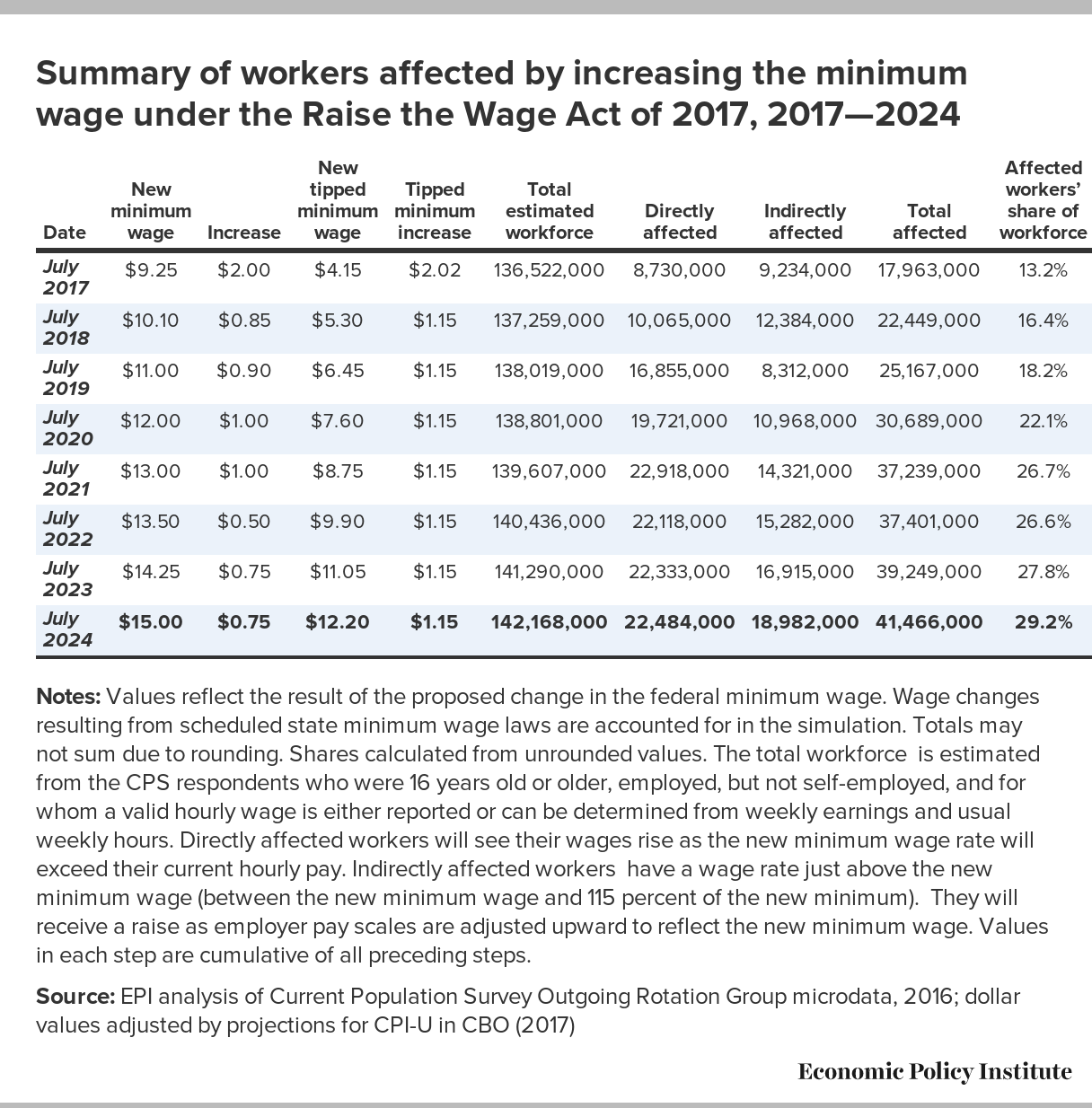

Source: www.epi.org

Source: www.epi.org

Raising the minimum wage to 15 by 2024 would lift wages for 41 million, Deducting social security and medicare taxes. Congress enacted aca with a 9.5% affordability threshold, but that number changes annually to reflect cost of living adjustments.

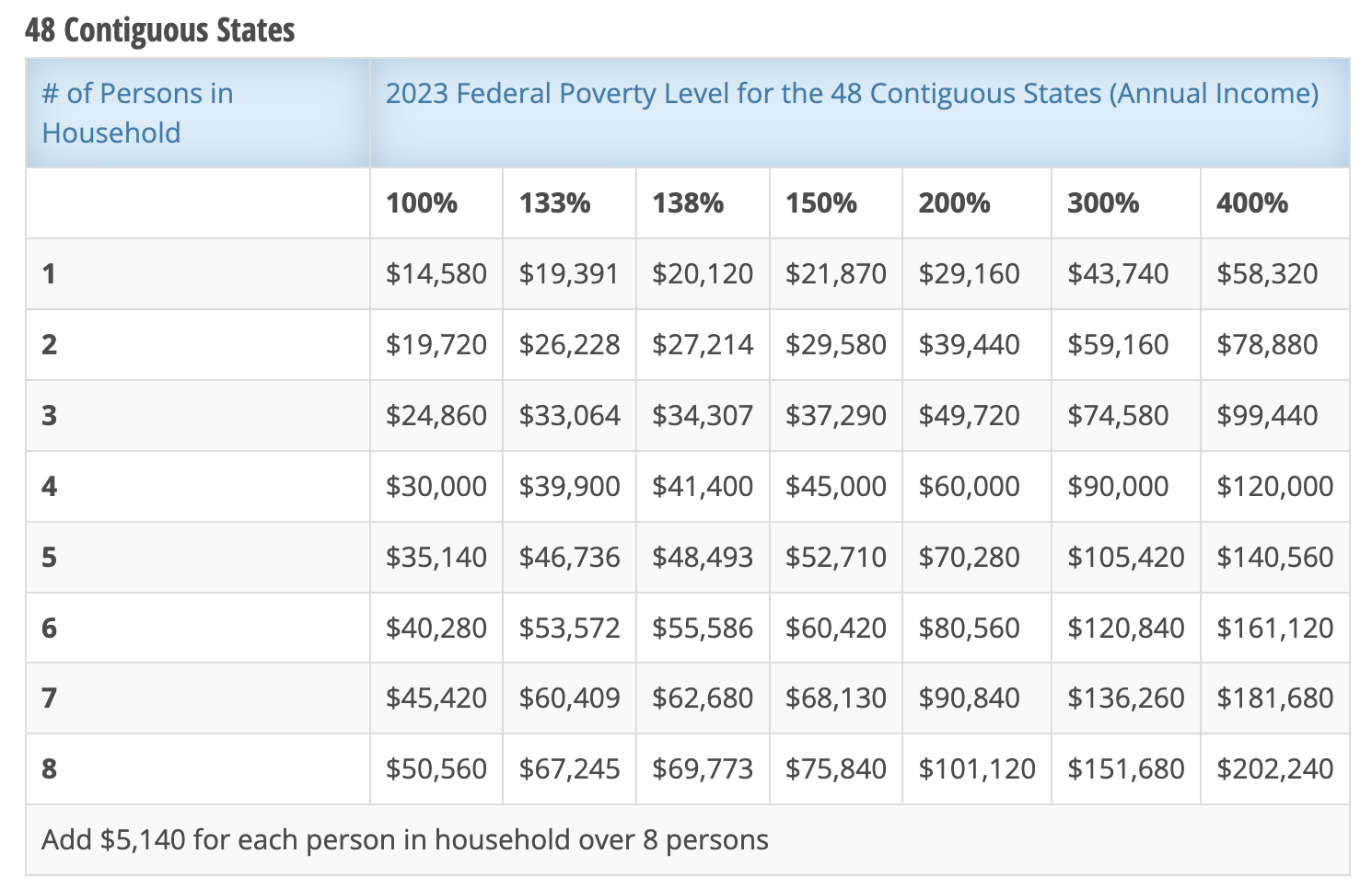

Source: www.immi-usa.com

Source: www.immi-usa.com

USCIS Federal Poverty Guidelines for 2023 Immigration Updated, As an employer, you pay a 6.2% social security tax on up to $168,600 (in 2024) of your employee’s earnings and. Find details on tax filing requirements with.

Source: www.axios.com

Source: www.axios.com

Here are the federal tax brackets for 2023, Here is a list of forms that household employers need to complete. Find details on tax filing requirements with.

Source: gtm.com

Source: gtm.com

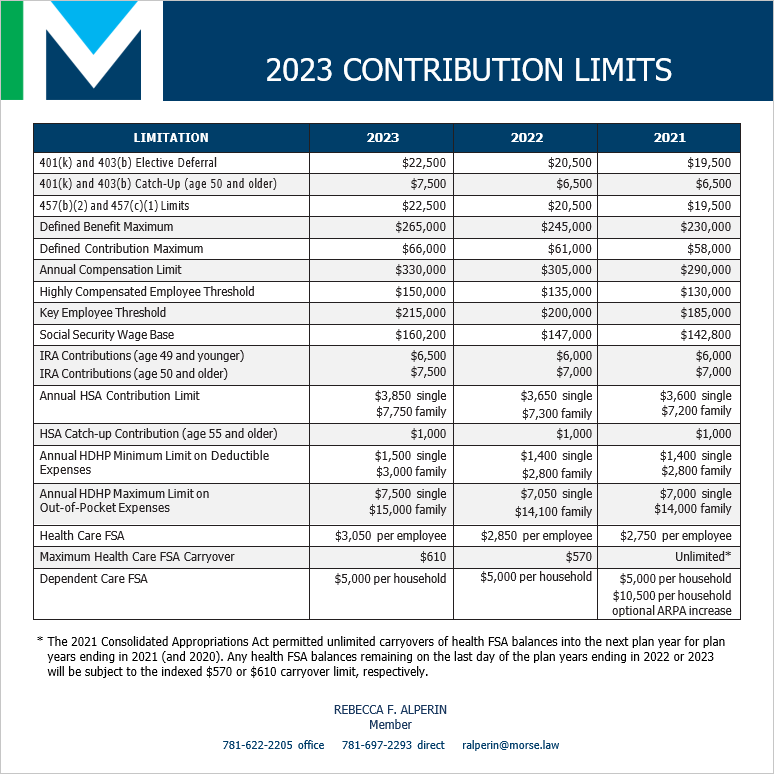

Household Employers IRS Announces 2024 Employee Benefit Plan Limits, The irs annually reviews, and adjusts as necessary, the wage payment threshold that obligates a. Social security and medicare tax for 2024.

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, Social security and medicare taxes apply to election workers who are paid $2,300 or. That is, you're not required to withhold.

Source: anna-dianewjessi.pages.dev

Source: anna-dianewjessi.pages.dev

Ss Earning Limit 2024 Beryle Leonore, For 2024, the domestic employee coverage threshold amount is $2,700, and the coverage threshold amount for election. The limit on earnings subject to social security taxes for 2024 will increase to $168,600.

Source: www.morse.law

Source: www.morse.law

Employee Benefit Plan Limits IRS 2023 Morse, Find details on tax filing requirements with. Social security and medicare taxes apply to election workers who are paid $2,300 or.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, 2024 payroll tax rates, taxable wage limits, and maximum benefit amounts unemployment insurance (ui) • the 2024 taxable wage limit is $7,000 per. Specific coverage thresholds for 2024.

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

2023 Tax Withholding Tables Example, Here is a list of forms that household employers need to complete. Deducting social security and medicare taxes.

2024 Payroll Tax Rates, Taxable Wage Limits, And Maximum Benefit Amounts Unemployment Insurance (Ui) • The 2024 Taxable Wage Limit Is $7,000 Per.

Specific coverage thresholds for 2024.

Social Security And Medicare Taxes Apply To Election Workers Who Are Paid $2,300 Or.

Schedule h (form 1040) for figuring your household employment taxes.